Capital Gains Tax 20242024a. A guide to capital gains tax (cgt) for individuals and entities with complex cgt obligations. What is cost inflation index?

It is popularly used to calculate indexed cost of acquisition, while calculating capital gains at the time of sale of any capital asset. Add this to your taxable income.

Section 54Ec Bonds, Also Known As Capital Gain Bonds Are Fixed Income Instruments Which Provide Capital Gains Tax Exemption Under Section 54Ec To The Investors.

A guide to capital gains tax (cgt) for individuals and entities with complex cgt obligations.

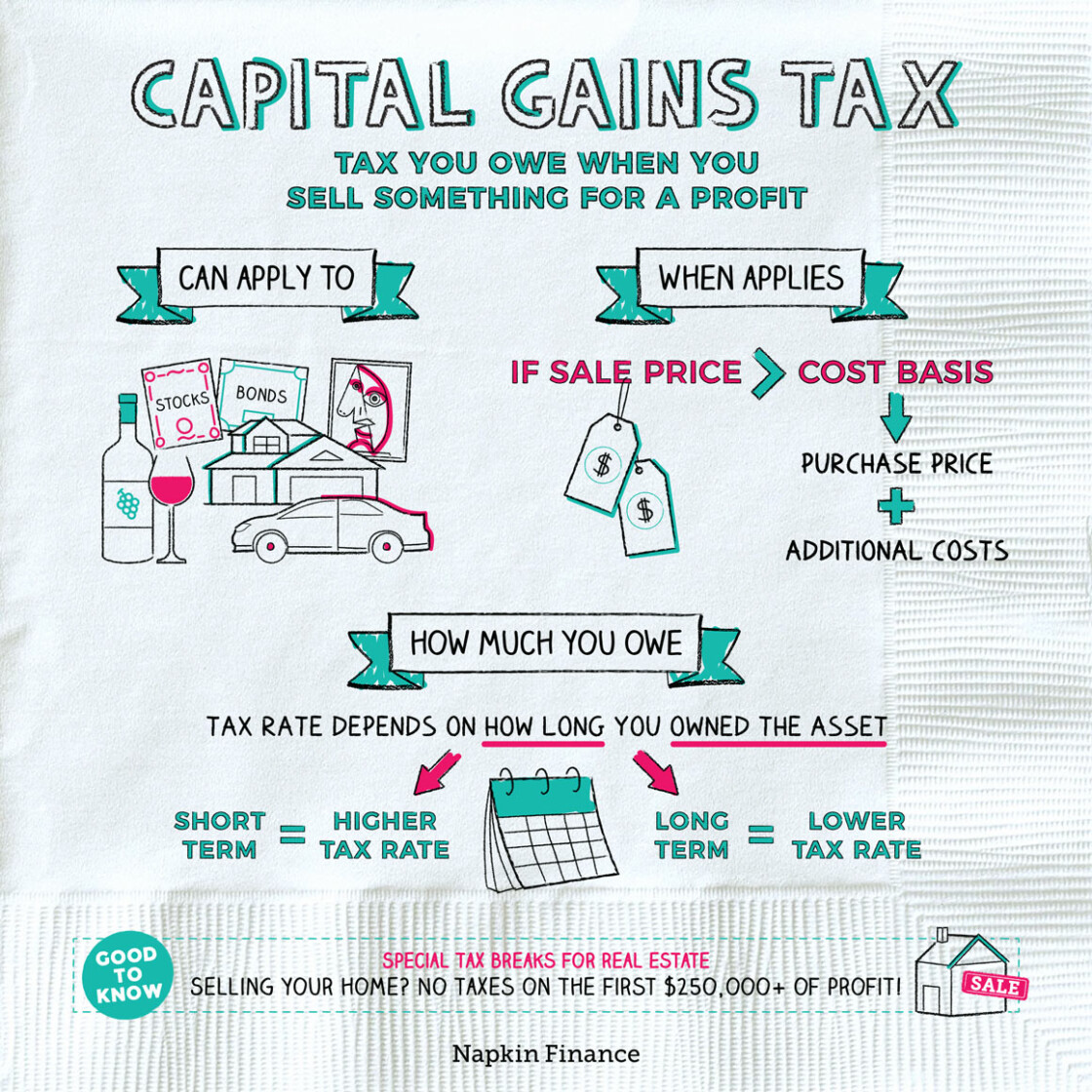

Capital Gains Tax Is A Tax On The Profit When You Sell (Or ‘Dispose Of’) Something (An ‘Asset’) That’s Increased In Value.

Justin, an australian resident, buys a block of land.

The Rates Are 0%, 15% Or 20%, Depending On Your Taxable Income And Filing Status.

Images References :

Source: www.philippinetaxationguro.com

Source: www.philippinetaxationguro.com

Capital Gains Tax How it Works and What You Need to Know TAXGURO, There is a capital gains tax (cgt) discount of 50% for australian individuals who own an asset for 12 months or more. The rate goes up to 15 percent on capital gains if you make between $47,026 and $518,900.

Source: ritchiephillips.co.uk

Source: ritchiephillips.co.uk

Your guide to Capital Gains Tax planning Ritchie Phillips, Last updated on 11 january, 2024. The rates are 0%, 15% or 20%, depending on your taxable income and filing status.

Source: lorainewdyane.pages.dev

Source: lorainewdyane.pages.dev

Capital Gains Tax Law 2024 Jere Garland, 20% after taking benefit of indexation; This change applies to corporations, trusts, and individuals.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Capital Gains Tax Rates Alice Brandice, This change applies to corporations, trusts, and individuals. There is a capital gains tax (cgt) discount of 50% for australian individuals who own an asset for 12 months or more.

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Capital Gains Definition, Rules, Taxes, and Asset Types, Explore terms, holding periods, and tax rates. Guide to capital gains tax 2024.

Source: ollyqnanette.pages.dev

Source: ollyqnanette.pages.dev

Short Term Capital Gains Tax Rate 2024 Allix, Justin, an australian resident, buys a block of land. A guide to capital gains tax (cgt) for individuals and entities with complex cgt obligations.

Source: www.kkcpa.ca

Source: www.kkcpa.ca

Capital Gains and Taxes What You Need to Know in 2023 » K.K. Chartered, Chris wood, global equity strategist at jefferies, believes potential capital gains tax changes in the july budget pose a bigger threat to indian markets than the 2024 lok sabha elections. The inclusion rate for capital gains will increase from ½ to ⅔.

Source: investdale.com

Source: investdale.com

Capital Gains Tax Guide LongTerm vs. ShortTerm Investdale, If a loan is taken on the security of the new specified asset within 3 years, the same will be treated as capital gains. To be eligible for exemption under section 54ec, the taxpayer must meet the following conditions:

Source: tullymortgages.ca

Source: tullymortgages.ca

Capital Gains Tax How it's calculated Marshall Tully, Mortgage Agent, This means you pay tax on only half the net capital gain on that asset. If a loan is taken on the security of the new specified asset within 3 years, the same will be treated as capital gains.

Source: napkinfinance.com

Source: napkinfinance.com

Capital Gains Tax Guide Napkin Finance, However, there are several legitimate strategies you can employ to save on capital gains tax. If a new asset is sold within 3 years, the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon.

20% After Taking Benefit Of Indexation;

If a loan is taken on the security of the new specified asset within 3 years, the same will be treated as capital gains.

The Rates Are 0%, 15% Or 20%, Depending On Your Taxable Income And Filing Status.

With the addition of the 3.8% net investment income tax (niit) designed to fund the affordable care act, and the additional medicare tax, the total capital gains rate could reach 44.6%.